Have you ever imagined what would happen if the universe forgot your birthday?

In a world full of uncertainties, life insurance is the perfect “Plan B” to ensure that your loved ones are protected, no matter what the future holds.

In this article, we will explore the fascinating world of life insurance and how it can be your safety net in times of need.

Life is an unpredictable journey, filled with unexpected moments.

Sometimes, life bestows upon us joy and accomplishments, like a memorable birthday.

However, there are also moments of sadness and uncertainty, such as unforeseen situations that can impact our financial security.

Life insurance is the link that connects these seemingly contradictory moments.

It is designed to provide financial security to your beneficiaries, ensuring that they are supported even when you’re no longer around to celebrate birthdays and create memories.

Life insurance is a financial safety net that helps your loved ones maintain their quality of life when you’re not there to provide for them.

It can cover various expenses, including:

Knowing that your family will be financially secure after your passing brings peace of mind.

Life insurance can help alleviate the stress and anxiety associated with an uncertain future.

Life insurance can be a way to leave a financial legacy for your beneficiaries.

It can fund their dreams and aspirations, whether it’s starting a business, pursuing higher education, or simply enjoying a comfortable retirement.

Funerals and end-of-life expenses can be a significant financial burden for your family.

Life insurance can cover these costs, allowing your loved ones to say their goodbyes without added financial stress.

There are several types of life insurance, each tailored to different needs and preferences. Here are the most common types:

Choosing the right life insurance policy depends on your individual circumstances and goals.

It’s essential to consider your current financial situation, future needs, and budget.

A financial advisor or insurance expert can help you navigate the various options and tailor a policy to your specific requirements.

While the universe may occasionally forget your birthday, life insurance is there to ensure that your family’s financial well-being is never overlooked.

It’s a responsible and caring step that individuals can take to protect their loved ones in times of adversity.

Life insurance isn’t just a financial product; it’s a symbol of your enduring love and commitment to your family’s future.

So, even when the universe has its forgetful moments, your legacy and support will always be remembered.

In the grand narrative of life, let life insurance be your ultimate backup plan, providing security, peace of mind, and a lasting legacy for the ones you cherish most.

While the universe may occasionally forget your birthday, life insurance is there to ensure that your family’s financial well-being is never overlooked.

It’s a responsible and caring step that individuals can take to protect their loved ones in times of adversity.

Life insurance isn’t just a financial product; it’s a symbol of your enduring love and commitment to your family’s future.

So, even when the universe has its forgetful moments, your legacy and support will always be remembered.

In the grand narrative of life, let life insurance be your ultimate backup plan, providing security, peace of mind, and a lasting legacy for the ones you cherish most.

Determining the right amount of life insurance coverage is a critical decision. Here are some factors to consider when calculating your coverage needs:

Start by assessing your family’s current and future financial needs. This includes everyday expenses, future education costs for your children, and outstanding debts.

Consider how much income your family would need to replace if you were no longer there to provide for them. Multiply your annual income by the number of years you’d like to replace.

Factor in any outstanding debts, such as a mortgage, car loans, or credit card balances. Your life insurance should be sufficient to cover these liabilities.

Include the costs of a funeral, medical bills, and any other end-of-life expenses your family might encounter.

Think about any long-term goals, such as sending your children to college, starting a business, or retiring comfortably. Ensure your life insurance coverage aligns with these objectives.

Once you’ve determined your coverage needs, it’s time to shop for the right life insurance policy. Here are some steps to consider:

Get quotes from different insurance providers to compare coverage options and premiums. This will help you find the most cost-effective policy that meets your needs.

Review the policy terms and conditions carefully. Be aware of any exclusions or limitations that may apply.

Consider seeking guidance from a financial advisor or insurance specialist. They can offer valuable insights and help you make an informed decision.

Life insurance is not just a financial product; it’s a gift to your loved ones, ensuring their well-being when they need it most.

It’s the ultimate backup plan that doesn’t depend on the universe remembering your special occasions.

It’s a reminder that you care about your family’s future, no matter what life may bring.

In a world filled with uncertainty, life insurance provides a sense of security, offering a safety net for your loved ones.

It is the ultimate backup plan, ensuring that your family’s financial well-being is protected, even when the universe has its forgetful moments.

So, as you celebrate your next birthday, remember that life insurance is the gift that keeps on giving, providing peace of mind and financial security for the ones you hold dear.

Don’t wait for the universe to remember; take action now to protect your family’s future. Life insurance is not just about securing your legacy; it’s about securing their future.

Investing in life insurance is a thoughtful and responsible decision that demonstrates your commitment to your loved ones, no matter what life’s journey may hold.

All

Loans For Medical Emergency: Navigating Medical Emergencies and Comprehensive Guide to Loans

Loans For Medical Emergency - In life, unexpected medical emergencies can arise, putting a strain on both physical well-being and financial stability.

This guide aims to shed...

All

Loans For Medical Emergency: Navigating Medical Emergencies and Comprehensive Guide to Loans

Loans For Medical Emergency - In life, unexpected medical emergencies can arise, putting a strain on both physical well-being and financial stability.

This guide aims to shed...

All

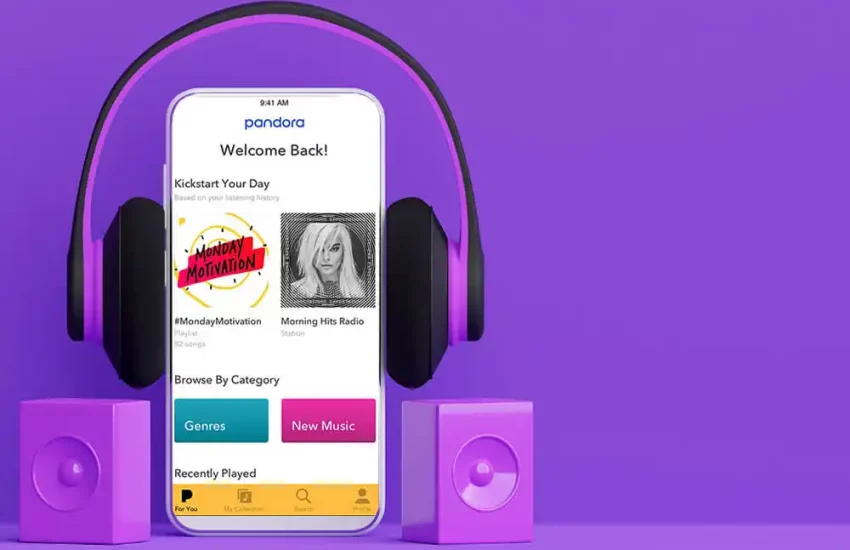

Explore Pandora Radio For Mobile Devices

Personalization is one of the best things that modern technology brings.

Today, I can watch a show or movie on a streaming service and get suggestions for similar content.

I can...

All

Explore Pandora Radio For Mobile Devices

Personalization is one of the best things that modern technology brings.

Today, I can watch a show or movie on a streaming service and get suggestions for similar content.

I can...

All

No Interest Period Credit Card: Pros and Cons

If you're looking to save money on interest charges, a no interest period credit card may be a good option for you.

These cards offer a promotional period during which you...

All

No Interest Period Credit Card: Pros and Cons

If you're looking to save money on interest charges, a no interest period credit card may be a good option for you.

These cards offer a promotional period during which you...

Home | Contact | Privacy Police | About Us | Terms

Nicy Apps is a content blog focused on cars, insurance, and credit cards that brings the latest news and trends in the sectors, also presenting application tips for those who like to update themselves and know the best applications available on the Android and IOS platforms.

All rights reserved to Kadosh Digital - 45.172.136/0001-17