Scotiabank App – Learn How To Download And Apply For A Card

Today, most errands are done digitally or online because people value convenience.

That’s why Scotiabank has launched a mobile banking app that allows customers to bank on the go.

Use the Scotiabank Mobile Banking app to easily pay bills, transfer money, receive e-bills, check credit scores, deposit checks from home and manage account information.

Read this guide to learn more about the benefits of using the Scotiabank Mobile Banking app.

Learn about the safeguards Scotiabank uses to protect its customers’ information.

Finally, see how easy it is for me to apply for a Scotiabank card directly from the mobile banking app.

Scotiabank, officially known as Nova Scotiabank or La Banque de Nouvelle-Écosse, is a Canadian financial institution.

The Canadian city of Toronto is home to the banking group’s global headquarters.

Scotiabank is considered one of Canada’s “Big Five” financial institutions.

Scotiabank is Canada’s third-largest bank by market capitalization and deposits.

As a global company, it serves approximately 25 million customers and clients.

The Scotiabank brand is currently present in more than 20 countries.

Australia, Bahamas, Brazil, Canada, China, Costa Rica, Hong Kong, India, Japan, Malaysia, Mexico, Singapore, United States of America, and the United Kingdom are just a few of the countries in which this bank operates.

Scotiabank wants to meet customer needs anytime, anywhere.

The bank has developed a mobile banking app so that customers can use the bank’s services even when they are in line, just getting out of bed or busy at home.

With this in mind, the Scotiabank Mobile Banking app offers great convenience to Scotiabank customers.

The bank ensures that its banking services are available on the Scotiabank mobile banking app.

Scotiabank customers can bank the way they want, anytime, anywhere.

Customers can download the Scotiabank Mobile Banking app for free from the Google Play Store or Apple App Store.

When I download the Scotiabank Mobile Banking app, my bank account number and other personal information are asked to verify that I have a Scotiabank account.

The app also expects me to enter user account information, including the password for my Scotiabank mobile banking account.

It is a common problem that others may be able to access your account and make unauthorized transactions.

As such, Scotiabank keeps users of its mobile banking app safe with biometric authentication.

I can log into my Scotiabank Mobile Banking app account using my fingerprint or Face ID.

To set it up, I clicked “More” on the app’s home screen to set up biometric authentication.

Then I clicked “Privacy & Security” and clicked “Manage Touch ID”.

Scotiabank Mobile Banking can pay bills.

This means I save time because I don’t have to wait in long lines to pay my monthly bills.

Once the transaction is complete, I will receive a reference number and receipt as proof of payment, just like paying in person at a Scotiabank branch.

However, it can take up to three days for bill payments to be processed through the mobile banking app.

For example, Scotiabank reminds customers to pay their bills online a few days before the due date, giving the billing company time to process the payment before the actual due date.

The Scotiabank Mobile Banking app also records all transactions, so users always know their payment information.

Another thing I found handy with the Scotiabank app is the automatic payment feature.

This means I don’t always have to provide my billing account information when I want to pay.

The bank asks the user if they want to set up automatic transfers through the app.

This feature includes credit cards, mortgage payments, and utility bills.

AutoPay allows me to pay my mortgage early so I don’t miss deadlines and avoid late penalties.

To do this, I need to set up or select a mortgage account in the Scotiabank Mobile Banking app.

Then I had to click on “Additional Services” to see the available payment methods.

Generally speaking, Scotiabank makes it easy for our clients to manage, pay, prepay and repay our Scotiabank Mortgage Account.

In the app, I can also see how much prepayment is left.

Scotiabank Mobile Banking makes it easy to send money to others, so I can split a bill or pay someone with just a few taps.

Interac e-Transfer is a service from Scotiabank that allows you to send, request and receive money to friends, family and colleagues quickly and easily.

This service is only available to Canadian account holders, which means I can only send and receive money online to people with Canadian bank accounts.

To use this service, customers must first add the person they want to send or receive funds to as a contact for Interac e-Transfer.

Interac e-Transfer has a limit on the number of transactions that can be performed per day, and the number of transactions varies for each client.

On the Account page, click Manage My Account to see how much you can transfer.

From your profile, select Manage ScotiaCard and Account Access.

Finally, click “Fastcash Account Setting” to view the limit.

Scotiabank also makes it easy and secure to send money to or outside of Canada.

Scotia International Money Transfer allows me to send money anywhere in the world using the Scotiabank Mobile Banking app.

Compared to other money transfer services, it has lower fees.

I like that Scotiabank wants us to pay as little as possible so that the recipient gets a larger amount.

This service also allows me to avoid extra charges.

I just add recipients as contacts in the app, just like with Interact e-Transfer.

After adding the person as a contact, I can always send them money immediately.

However, this service limits the amount I can transfer, which varies by account.

Scotiabank Mobile Banking also tracks any accounts processed, paid or received through the app.

Scotiabank is urging its customers to move to paperless electronic statements.

I have the option to get all my bank statements electronically through the app, which is faster and easier to use.

The information collected by the app is also secure, so there is no information leakage.

I can still print and download eStatements for the past 24 months.

The application keeps reports for seven years.

Together with the e-Statement, I can avoid receiving a hard copy of my credit score because I can see them directly in the Scotiabank Mobile Banking app.

With TransUnion Credit Score, I can track how my credit score changes each month and review my credit report.

All I have to do is click the “TransUnion Credit Score” button in the app at any time to check my credit score.

The bank advised me to sign up for TransUnion Credit Score before I could read and agree to the terms and conditions of the service.

There are also some tips on how to improve your credit score on the Scotiabank Mobile Banking app.

Scotiabank Mobile Banking makes it easier to deposit checks at home.

This means I can cash checks without having to go to the branch and do it manually.

I need to take a photo of a check using Scotiabank Mobile Banking.

On the main screen, I need to click on “Transfer” and search for “Deposit Check”.

Then I have to select the Scotiabank account I want to deposit the money into and enter the amount.

The next step is to photograph the front and back of the check.

After that, Scotiabank notified me that the transaction or deposit was successful.

For added convenience, Scotiabank supports applying for or applying for a new card through the Scotiabank Mobile Banking app.

I just need to log in to my online banking or mobile banking account.

Then I had to select the “Manage My Account” option on the Accounts page. After that, I need to click on the “Profile” button.

In the end, I have two options: replace or replace the Scotiacard.

More posts to read: Nicy Apps

The Scotiabank Mobile Banking app is also a great way to manage and update my bank account information.

The Scotiabank app makes it easy for me to check my account balance and view transactions that have been made.

I can also change my address at any time and the change will be reflected in bank records immediately.

Checks can also be ordered online so I don’t have to go to a branch to get them.

The Scotiabank Mobile Banking app allows users to securely and easily access banking services from their mobile device.

Customers have a variety of online banking options, including bill payment, domestic and international money transfers, account management, and the ability to deposit checks from home.

You can download all the apps on:

All

Top 10 Richest People In The World – 1

1. Elon Musk

Age: 51

Birthplace: Texas

Co-founder and CEO: Tesla

Net worth: $203 billion

Tesla ownership: 15% ($90.6 billion)

Other holdings: Space Exploration...

All

Top 10 Richest People In The World – 1

1. Elon Musk

Age: 51

Birthplace: Texas

Co-founder and CEO: Tesla

Net worth: $203 billion

Tesla ownership: 15% ($90.6 billion)

Other holdings: Space Exploration...

All

Life Insurance for Veterans Over 40: What You Need to Know

Life Insurance for Veterans Over 40 - As a veteran over 40, you may be considering life insurance options to protect your loved ones in the event of your passing.

It's...

All

Life Insurance for Veterans Over 40: What You Need to Know

Life Insurance for Veterans Over 40 - As a veteran over 40, you may be considering life insurance options to protect your loved ones in the event of your passing.

It's...

All

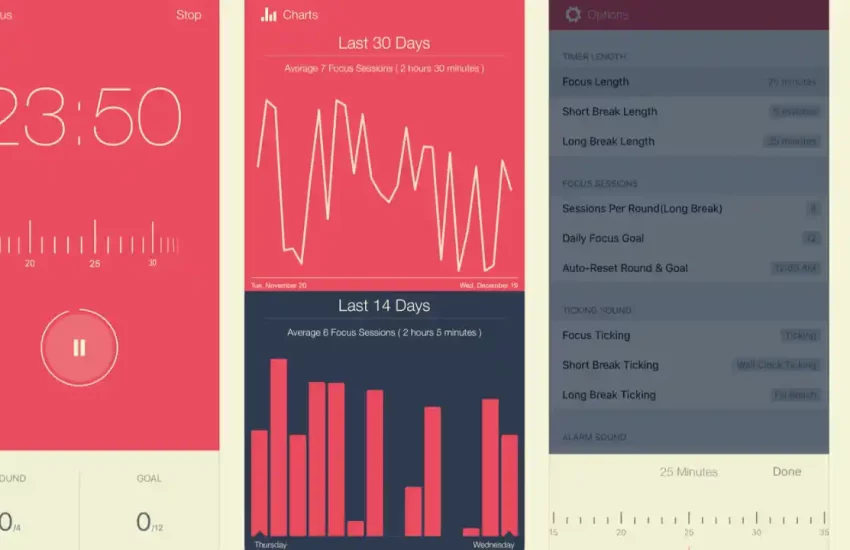

Discover 7 Organizational Apps That Can Save You Time

As many have said, time is a precious commodity and no one can lose it.

So whether you're at the office or at home, it's always important to plan your day.

Anyone looking to be...

All

Discover 7 Organizational Apps That Can Save You Time

As many have said, time is a precious commodity and no one can lose it.

So whether you're at the office or at home, it's always important to plan your day.

Anyone looking to be...

Home | Contact | Privacy Police | About Us | Terms

Nicy Apps is a content blog focused on cars, insurance, and credit cards that brings the latest news and trends in the sectors, also presenting application tips for those who like to update themselves and know the best applications available on the Android and IOS platforms.

All rights reserved to Kadosh Digital - 45.172.136/0001-17