As people age, their insurance needs change.

Seniors have different life insurance needs than younger adults and children.

They often need more coverage and have a limited budget.

It is important to find the best life insurance for seniors that meets their needs and budget.

There are many factors to consider when choosing life insurance for seniors.

[read more]

The type of policy, the death benefit, the premium, and the riders are all important factors.

Seniors should also compare policies from different companies to get the best rate.

There are three main types of life insurance for seniors: term life, whole life, and universal life.

Term life insurance is the most affordable option and covers seniors for a set period of time.

Whole life insurance costs more but offers coverage for the rest of the senior’s life.

Universal life is a flexible policy that allows seniors to change the death benefit and premium payments.

Getting the best life insurance for seniors requires shopping around and comparing rates from different companies.

It is also important to understand the different types of policies before choosing one. Working with an experienced agent can help seniors find the best policy for their needs.

As people age, they often face new challenges and risks.

One of the biggest financial risks that seniors face is the potential need for long-term care.

Long-term care costs can quickly drain savings and deplete other assets, leaving a senior’s loved ones struggling to make ends meet.

Life insurance can help mitigate the financial burden of long-term care costs.

If a senior purchases a life insurance policy with long-term care benefits, their loved ones can use the death benefit to cover the cost of long-term care should the senior require it.

This can help alleviate some of the financial stress associated with providing long-term care.

In addition to helping with long-term care costs, life insurance can also provide financial security for a senior’s loved ones in the event of their death.

The death benefit from a life insurance policy can be used to cover funeral and burial expenses, pay off debts, or provide income replacement for dependents. This can help ease the financial burden on a senior’s loved ones during an already difficult time.How life insurance can benefit seniors.

Life insurance provides peace of mind and financial security for seniors and their loved ones.

It can help cover the cost of long-term care and other expenses in the event of the senior’s death.

There are many different types of life insurance available, so it’s important to compare policies and choose one that best meets your needs.

When determining the best life insurance policy for seniors, there are a few key factors to consider.

Once you have decided on the key factors that are important to you, it is time to start comparing life insurance policies.

When doing so, be sure to look at:

Term life insurance is the most basic type of life insurance and is ideal for seniors who want coverage for a specific period of time, such as 10 or 20 years.

This type of policy does not build cash value, so it is typically less expensive than other types of life insurance.

This Whole life insurance provides lifelong protection and builds cash value over time, making it more expensive than term life insurance.

Whole life policies also typically have higher premiums than term life policies, so they may not be the best option for seniors on a budget.

However, whole life policies can be a good option for seniors who want the peace of mind of knowing they are covered for their entire lives.

Universal life insurance is similar to whole life insurance in that it provides lifelong protection and builds cash value over time.

However, universal life policies have more flexible premium payments and death benefit options than whole life policies, making them a good choice for seniors who want more control over their coverage.

The first step is to understand what your needs are.

You should take into account factors such as your age, health, financial situation and dependents.

Once you have a good understanding of your needs, you can start shopping around for life insurance policies.

It is important to compare different policies and companies before making a decision.

Make sure to look at things like the death benefit, premiums, riders and exclusions.

You can use online tools or seek out the help of a professional to make comparisons.

Once you have found a few policies that meet your needs, it is important to read the fine print carefully before signing anything.

Make sure you understand all the terms and conditions before making any commitments.

When shopping for life insurance for seniors, it is important to ask lots of questions in order to make an informed decision.

Here are some questions you should ask:

When it comes to finding the best life insurance for seniors, it is important to take into account several factors.

These include the need for coverage, the type of policy that best suits their needs, and how to get the best rates.

By taking these steps, seniors can be sure to find the life insurance policy that best meets their needs.

Read more:

[/read]

All

Credit Repair – 7 Steps to Take If You Want to Improve Your Credit Score

Credit Repair - When you have bad credit, it can be difficult to rebuild your financial reputation.

But there are ways to fix your credit quickly.

Credit Repair - Here's...

All

Credit Repair – 7 Steps to Take If You Want to Improve Your Credit Score

Credit Repair - When you have bad credit, it can be difficult to rebuild your financial reputation.

But there are ways to fix your credit quickly.

Credit Repair - Here's...

![[VIDEO] He sticks a needle in a banana and looks what happens next!](https://nicyapps.com/wp-content/uploads/2022/11/banana-needle-1.webp) All

[VIDEO] He sticks a needle in a banana and looks what happens next!

This needle trick is really useful!

Bananas are not just delicious fruits, they are also super healthy.

For example, eating two bananas a day can do wonders for your...

All

[VIDEO] He sticks a needle in a banana and looks what happens next!

This needle trick is really useful!

Bananas are not just delicious fruits, they are also super healthy.

For example, eating two bananas a day can do wonders for your...

All

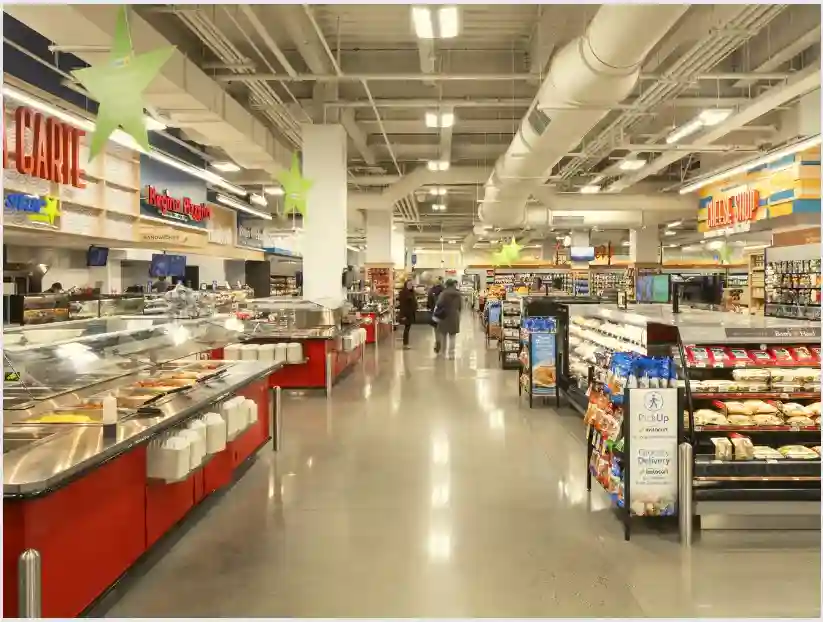

How To Get Discounts With Star Market Deals & Delivery App

Founded in 1915, Star Market is a well-known grocery chain that values hard work, family and customers.

These values are still valid after a century.

As proof, the STAR store...

All

How To Get Discounts With Star Market Deals & Delivery App

Founded in 1915, Star Market is a well-known grocery chain that values hard work, family and customers.

These values are still valid after a century.

As proof, the STAR store...

Home | Contact | Privacy Police | About Us | Terms

Nicy Apps is a content blog focused on cars, insurance, and credit cards that brings the latest news and trends in the sectors, also presenting application tips for those who like to update themselves and know the best applications available on the Android and IOS platforms.

All rights reserved to Kadosh Digital - 45.172.136/0001-17