Are you on a quest to find the best credit card that suits your financial needs and lifestyle? Look no further! In this comprehensive guide, we’ll walk you through the ins and outs of credit cards, helping you make an informed decision about the best credit card for you. From earning rewarding perks to managing your finances responsibly, we’ll cover everything you need to know. Let’s embark on this journey to find your perfect match!

Before diving into the search for the best credit card, let’s grasp the basics. Credit cards are financial tools that allow you to borrow money from a lender (usually a bank or credit union) to make purchases. The borrowed amount is paid back monthly, with the option to carry a balance and incur interest charges if you don’t pay in full.

Credit cards come in various types, each catering to different needs:

The best credit card for you depends on your financial goals and lifestyle. Ask yourself:

Understanding your needs will guide you towards the right credit card category.

Armed with your needs in mind, it’s time to explore the vast array of credit card offers available. Thanks to modern technology, comparison shopping has never been easier. Online platforms like CreditCards.com and NerdWallet offer user-friendly tools to compare credit card features and benefits side-by-side.

When comparing credit cards, consider these factors:

Once you’ve narrowed down your options, read reviews from other cardholders. Real-life experiences can provide valuable insights into a credit card’s pros and cons. Websites like Trustpilot and Consumer Affairs feature user-generated reviews that can influence your decision positively.

Keep in mind that your credit score plays a crucial role in determining whether you qualify for the best credit card offers. Generally, a higher credit score opens doors to more favorable terms, such as lower interest rates and higher credit limits. Obtain a free credit report from AnnualCreditReport.com to review your credit history and identify areas for improvement.

As you embark on your credit card journey, be aware of potential pitfalls. Avoid:

Once you’ve found the best credit card that suits your needs, it’s time to apply! Follow the application instructions carefully, and provide accurate information. Be patient, as the approval process may take a few days. If approved, make sure to read and understand the terms and conditions provided by the issuer.

Congratulations! You now hold the best credit card that aligns with your lifestyle. To make the most of it:

In the vast landscape of credit cards, finding the best credit card that suits your unique needs is an exciting and rewarding journey. Armed with knowledge and insights from this guide, you are now equipped to navigate the credit card world with confidence. Remember to choose a card that aligns with your financial goals, use it responsibly, and monitor your progress. With the right credit card in your wallet, you can seize the opportunities for rewards, build your credit, and enjoy the convenience it brings to your everyday life. Happy credit card hunting!

Disclaimer: This article provides general information and should not be construed as financial advice. Please consult with a financial advisor before making any credit card decisions.

All

Life Insurance: The Ultimate Backup Plan for When the Universe Forgets Your Birthday

Have you ever imagined what would happen if the universe forgot your birthday?

In a world full of uncertainties, life insurance is the perfect "Plan B" to ensure that your loved...

All

Life Insurance: The Ultimate Backup Plan for When the Universe Forgets Your Birthday

Have you ever imagined what would happen if the universe forgot your birthday?

In a world full of uncertainties, life insurance is the perfect "Plan B" to ensure that your loved...

All

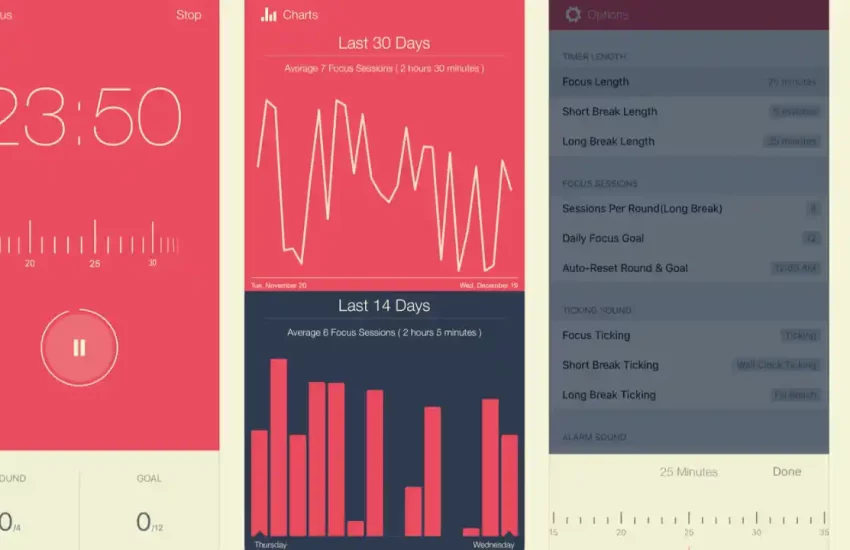

Discover 7 Organizational Apps That Can Save You Time

As many have said, time is a precious commodity and no one can lose it.

So whether you're at the office or at home, it's always important to plan your day.

Anyone looking to be...

All

Discover 7 Organizational Apps That Can Save You Time

As many have said, time is a precious commodity and no one can lose it.

So whether you're at the office or at home, it's always important to plan your day.

Anyone looking to be...

All

How Many Insurance Can You Have?

How Many Insurance Can You Have - If you have questions about how many insurance policies you can have, you're not alone!

Depending on the type of coverage and your...

All

How Many Insurance Can You Have?

How Many Insurance Can You Have - If you have questions about how many insurance policies you can have, you're not alone!

Depending on the type of coverage and your...

Home | Contact | Privacy Police | About Us | Terms

Nicy Apps is a content blog focused on cars, insurance, and credit cards that brings the latest news and trends in the sectors, also presenting application tips for those who like to update themselves and know the best applications available on the Android and IOS platforms.

All rights reserved to Kadosh Digital - 45.172.136/0001-17